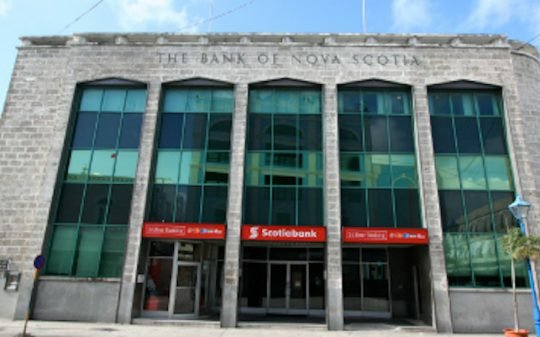

SCOTIA BANK LAY OFFS: Scotiabank to trim staff

Up to 20 Scotiabank (Barbados) staff members could find themselves on the breadline as a result of the sale of the financial institution’s Eastern Caribbean operations, Barbados TODAY has learned.

However, though not confirming the numbers or when the layoff process started, the bank said in a brief statement to this newspaper that the restructuring was necessary and discussions about the changes were held.

“As a result of the completion of the sale of Scotiabank operations in seven Eastern Caribbean countries, we will be restructuring our Managing Director’s Office in Barbados, particularly the centralized functions that supported the divested businesses,” the bank said.

“We have been discussing these changes with both our employees and our union partners over the past several months,” it added.

The Toronto-based bank drastically scaled down its operations earlier this month when it finalized an approximately US$123 million deal with Republic Financial Holdings Limited (RFHL), which operates Republic Bank.

The countries directly affected by the sale were, St Maarten and the Eastern Caribbean territories of Anguilla, Dominica, Grenada, St Kitts & Nevis, St Lucia and St Vincent and the Grenadines.

The operations will go to the RFHL, while the Scotia life insurance subsidiaries in Jamaica and Trinidad and Tobago will go to a new Sagicor subsidiary.

Scotiabank said the decision to restructure a portion of the Barbados market was not taken lightly and that the bank was committed to supporting employees throughout the process.

“Wherever possible, affected staff members will be redeployed to other areas of the business. The proposed staff changes will not affect our customers or customer service,” the bank assured, without saying what the changes would be specifically.

However, the commercial banking institution said it remained devoted to the Barbados market, reiterating comments made recently by its Senior Vice President of International Banking Brendon King during a recent visit.

“Scotiabank remains committed to Barbados. We continue to invest in new technology to help our customers as well as in our young people and communities,” said the bank.

Earlier this month, King pointed out that the bank would continue to invest in building out its digital footprint across the island in an effort to enhance customer experiences.

“Barbados remains a great market for us and we look forward to growing here for many years to come,” he added then.

Between 2015 and 2016, Scotiabank closed more than 30 branches and cut about ten per cent of its Caribbean workforce.

While at the time it was not made known how many people from Barbados would be affected, the bank did close its Black Rock, St Michael branch on June 12, but promised no jobs would be lost.

In July of this year the bank then closed its Holetown, St James branch, in keeping with the shrinking of its footprint in the region. That location was consolidated into the Warrens, St Michael branch, and at that time the bank had promised no job losses.

Scotiabank has been operating in Barbados since 1956.

barbadostoday.bb