Date March 30, 2021 Response Written Consultation Overview of budgetary decision-making after the Autumn Memorandum Dear Chairman, Enclosed you will find the answers to the questions of the standing committee for Finance posed on 16 February 2021, regarding the letter sent on 27 January 2021 with an overview of budgetary decision-making after the Autumn Memorandum. Yours sincerely, the Minister of Finance, W.B. Hoekstra Questions and comments from members of the group of the VVD The members of the VVD party have taken note of the overview of budgetary decision-making after the Autumn Memorandum. The members of the VVD group still have a few questions and / or comments about this. The members of the VVD group would like to know why an update of the estimate of tax revenues and autonomous expenditure development has not been included. Can an indication be given of this? The next estimate from the Central Planning Bureau (CPB) and the Central Economic Plan (CEP) is expected at the end of March. In this case, given all the developments, why is it waiting for the Spring Memorandum to inform the House of Representatives? Both tax revenues and autonomous expenditure development are highly dependent on the macroeconomic development estimated by the Central Planning Bureau (CPB). Currently, no current CPB estimate is available that takes into account the current contact-limiting measures and the most recent economic insights. Therefore, no discounting of tax revenues and autonomous expenditure development has been included. At the end of March, the CPB will publish the Central Economic Plan (CEP), containing an update of the expenditure and tax estimates. Subsequently, this CEP estimate and the budgetary consequences of the spring decision-making must be processed.

After that, the cabinet can inform parliament in the Spring Memorandum about the income, expenditure, EMU balance and EMU debt for 2021. The members of the VVD faction would like a more extensive substantiation of the amounts under item 2 “services and information management (POK)”. What exactly is being done for that? And why do those costs continue up to and including 2026? A breakdown of the amounts under item 2 “services and information management (POK)” is included in the appendix budgetary framework measures to the government’s response to the report “unprecedented injustice” by the Parliamentary interrogation committee on childcare allowance (POK). The reserved resources are intended for the implementation of the (partly structural) measures as announced in the Cabinet response. The members of the VVD group read that for 2021 to 2026 there are p.m. posts for the national program education after corona. How long is the duration of this program? And when is more clear about the costs and coverage? And why is the reservation for ventilation for the school buildings only in 2022 and 2023? Isn’t there a need for investments in ventilation in the context of Corona? When the relevant letter to Parliament was sent on 27 January last, the national program for education after corona was still being worked out. Because at that time already it was clear that the program (not yet quantifiable) would have budgetary consequences included in the letter p.m. items. On 17 February last, the cabinet informed the House of the details of the program by means of a letter to Parliament. It states that the program will run up to and including the 2022/2023 school year for primary and secondary education and up to and including 2022 for secondary and higher vocational education. A total of 8.5 billion is incidentally available for the program during this period. In addition, the consequences of the estimate of the numbers of pupils and students (increasing to 645 million structurally from 2026) and the study grant estimate (increasing to 132 million in 2026) are also generally processed. The House will be informed about this processing in the Spring Memorandum. On 1 October last, the House was informed by means of a letter to Parliament about the results of the investigation by the National Coordination Team Ventilation School Buildings (LCVS). In the same letter, a financial investment of 360 million was announced. Of that 360 million, 100 million has been made available via the SUVIS scheme, which will enable necessary ventilation measures in schools to be financed in the short term (2021). The remaining 260 million has been reserved by the cabinet for the years after 2021, so that the results of the Interdepartmental Policy Survey on Educational Housing can be included in the manner of spending. The members of the VVD faction see that the administrative agreements are getting stronger g Groningen are included. However, agreements have also been made about the reservoir regulation and the Norg gas storage. How and when are these processed in the financial picture? Why have these not yet been included, possibly as a p.m. post, for example? An update of the multi-year forecast is being worked on, when can the House be informed about this in more detail? The letter to Parliament gives an overview of those files with an effect on the expenditure ceiling up to the end of January on which a decision has already been taken. The reservoir regulation and the Norg gas storage are not included in the scope of this letter. Due to a reservation on the additional item, the reservoir regulation has no influence on the expenditure ceiling and will be incorporated in the Spring Memorandum 2021. On 9 March last, your House was informed of the signing of the Norg agreement (reference 2021Z04373). In accordance with the Norg Fee Agreement, GasTerra will draw up a calculation method for the fee, which will be determined by an arbitration panel. After it has been determined, the compensation

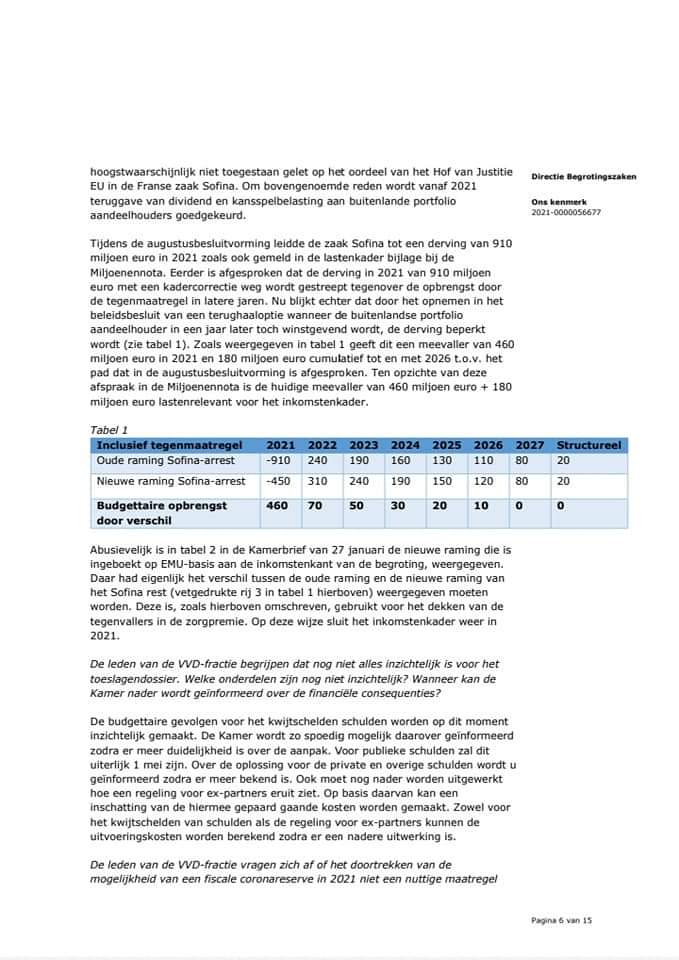

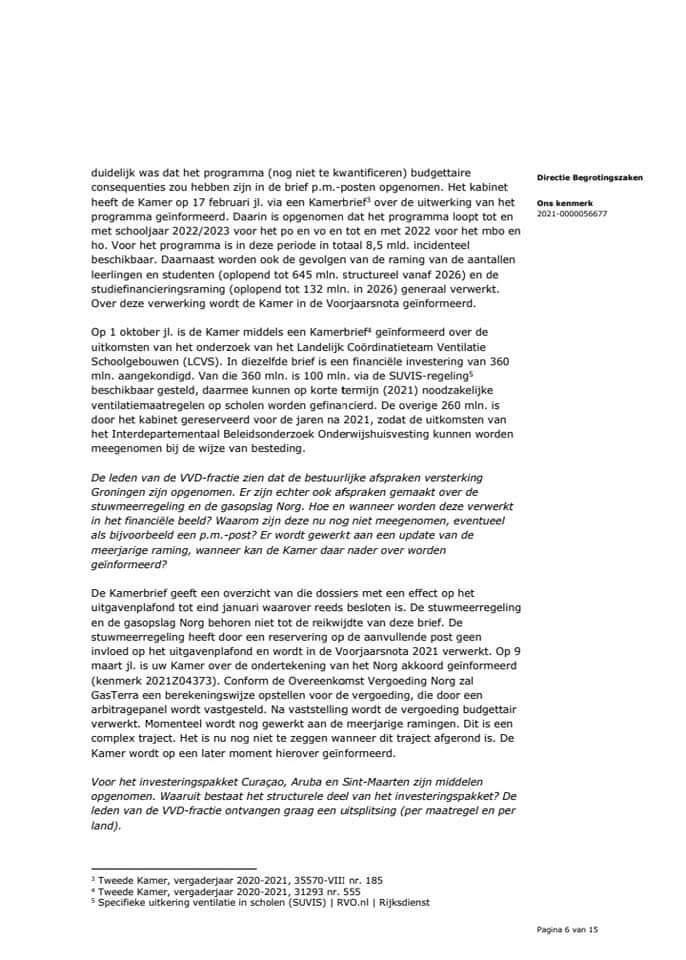

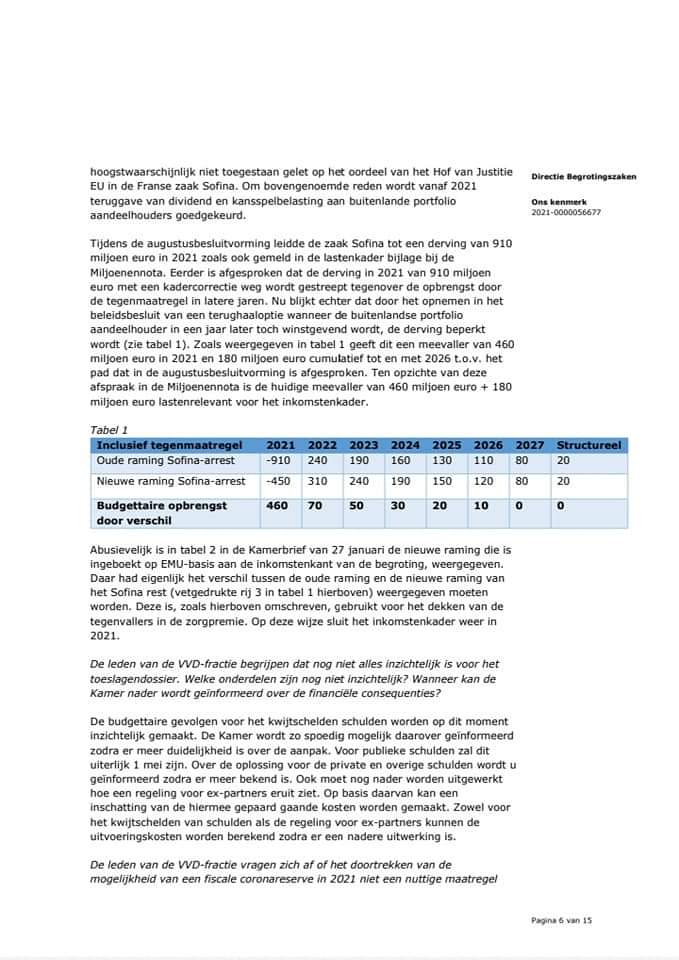

is processed in a budgetary manner. The multi-annual estimates are currently being worked on. This is a complex process. It is not yet possible to say when this process will be completed. The House will be informed about this at a later time. Funds have been included for the investment package Curaçao, Aruba and Sint Maarten. What does the structural part of the investment package consist of? The members of the VVD group would like to receive a breakdown (per measure and per country). The structural part of the investment package Curaçao, Aruba and Sint Maarten consists of investments in the rule of law. All expenditure under the rule of law is presented below, including incidental contributions. Investment package rule of law (x € million) 2020 2021 2022 2023 2024 2025 2026 struc. Curaçao 1.2 18.3 19.6 19.5 19.6 24.9 24.9 24.9 Strengthening border control (including Coastguard) 16.3 16.8 15.5 14.4 18.5 18.5 18.5 Sustainable undermining approach 0.4 1.6 2.8 4.0 5.2 5.2 5.2 Professionalizing ARUMIL and Social Training Course 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.2 Harmonization of personal data 0.4 Aruba 0.8 12.5 15.0 14.3 14.9 17.8 17.8 17.8 Strengthening border control 11.1 11.8 9.3 8.1 9.3 9.3 9.3 Sustainable undermining approach 0.6 2.4 4.2 6.0 7.7 7.7 7.7 Professionalising ARUMIL and Social Training program 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 Sint Maarten 0.0 2.7 2.9 2.7 2.4 2.7 2.7 2.7 Strengthening border control 2.7 2.9 2.7 2.4 2.7 2.7 2.7 Total 2.4 33.5 37.5 36.5 36.9 45.4 45.4 45.4 The members of the VVD group note that before 2021, the entire on = deferred assignment still has to be completed. Is it true that this is in addition to the in = de-commissioning of 1.2 billion euros, which still has to be completed by the Final Act? If not, what about then? What is the state of affairs regarding the implementation of this assignment? In the Autumn Memorandum 2020, an in = out target of 1.2 billion euros was open. The in = out target is the counterpart of the year-end margin. The end-of-year margin is intended to prevent ineffective use of resources at the end of the year by transferring the unspent resources to the following year. This is subject to a maximum of 1.0 percent of the total budget, with the exception of the defense equipment budget fund and the infrastructure fund, which have a 100 percent year-end margin. In order to prevent the expenditure ceiling from being exceeded as a result of the year-end margin, an equally large target is entered in the Spring Memorandum, the so-called in = out target. As a result, the transfer via the end-of-year margin does not generate additional resources in the year to which the transfer is made. The in = out target has no concrete interpretation, but is completed during the year. The interpretation can consist of (accidental) under-exhaustion or other windfalls. The remaining in = out target for 2020 for the Final Act amounts to 1.2 billion euros. This is a risk for the treasury: if the target cannot be met by the Final Act, this means a ceiling exceedance and a deterioration of the EMU balance in 2020. In addition to the in = out target, the Spring Memorandum has a target underutilisation of 500 million euros for the year 2020 in order to close the expenditure ceiling, this target is fully specified in the Millionnota with windfalls. An in = out target will also be booked for 2021 as a counterpart to the resources that will be carried forward from 2020 via the end-of-year margin. target for 2021. In addition to the in = out target, there is a target underutilization of 950 million euros for the year 20 for the 2021 Budget Memorandum. 21 booked to close the spending ceiling. Just like the in = out target in 2021, this target will have to be completed with underutilization or other windfalls. The members of the VVD faction would like to know what the “stock options envelope” is (was) for. In the context of the tax treatment of stock options as wages for employees of start-ups and scale-ups, among others, it is being investigated to what extent the current tax moment (time of exercise of the options) can be shifted to a time when liquid assets available to be able to pay the tax due at that time. A measure had been worked out for this with an intended entry into force date of 1 January 2021. 5 million euros had been reserved for this by 2021. After consultation with stock option experts, it has emerged that it is not clear whether this measure has the intended effect in enough cases. The proposal is therefore being further elaborated. The intended entry into force of the measure will then be effective 1 January 2022 and the measure is expected to be included in the Tax Plan 2022. This means that the envelope of 5 million euros will not be used in 2021. In the amendment by Member Lodders, the stock options envelope for the year 2021 has been used to cover a temporary increase in the gift tax exemption of 1,000 euros. From 2022, the envelope will be used to adjust the tax treatment of stock options. The members of the VVD group ask for a further explanation of point 7 “recalibration of Sofina judgment including countermeasure”. What exactly is meant here? What exactly does it say here? The answer below is a short version of the earlier explanation given in the Letter to Parliament on the development of the income side of 15 December 2020. An earlier judgment of the EU Court of Justice in the French Sofina case has partially approved the restitution of dividends and gambling tax to foreign portfolio shareholders. In this case, compared to the earlier estimate, there is now a budgetary windfall of 460 million euros in 2021 and 180 million euros cumulative in later years. The judgment in the Sofina case has consequences for the current law whereby bodies established in the Netherlands can fully offset the dividend tax and gambling tax against the amount of corporate income tax owed, even if they are loss-making. Bodies established abroad that are otherwise in the same position as entities established in the Netherlands do not have this settlement option. This difference is most likely not allowed in view of the judgment of the EU Court of Justice in the French Sofina case. For the above reason, the refund of dividends and gambling tax to foreign portfolio shareholders will be approved from 2021. During the August decision-making process, the Sofina case led to a loss of 910 million euros in 2021, as also reported in the tax framework annex to the Budget Memorandum. It was previously agreed that the loss of 910 million euros in 2021 with a framework correction will be offset against the proceeds from the countermeasure in later years. However, it now appears that by including a recall option in the policy decision when the foreign portfolio shareholder does become profitable in a year later, the loss is limited (see table 1). As shown in table 1, this gives a windfall of 460 million euros in 2021 and 180 million euros cumulative up to and including 2026, compared to the path agreed in the August decision-making. Compared to this agreement in the Budget Memorandum, the current windfall of 460 million euros + 180 million euros in expenses is relevant for the income framework. Table 1 Including countermeasure 2021 2022 2023 2024 2025 2026 2027 Structural Old estimate Sofina judgment -910 240 190 160 130 110 80 20 New estimate Sofina judgment -450 310 240 190 150 120 80 20 Budgetary income due to difference 460 70 50 30 20 10 0 0 By mistake, table 2 in the letter to Parliament of 27 January shows the new estimate entered on the EMU basis on the revenue side of the budget. There the difference between the old estimate and the new estimate of the Sofina remainder (row 3 in bold in table 1 above) should have been shown. As described above, this has been used to cover setbacks in the health insurance premium. In this way, the income framework will close again in 2021. The members of the VVD group understand that not everything is clear for the allowance file yet. Which parts are not yet transparent? When can the House be further informed about the financial consequences? The budgetary consequences fo

r canceling debts are currently being made transparent. The House will be informed about this as soon as possible as soon as more clear kheid is about the approach. For public debts, this will be no later than May 1. You will be informed about the solution for private and other debts as soon as more is known. It also needs to be worked out in more detail what a scheme for ex-partners looks like. Based on this, an estimate can be made of the associated costs. The implementation costs can be calculated for both the cancellation of debts and the arrangement for ex-partners as soon as there is further elaboration. The members of the VVD group wonder whether extending the possibility of a fiscal corona reserve in 2021 would not be a useful measure. What could that deliver? Table 3 states that a number of measures are “exclusive of behavioral effects”. What kind of behavioral effects can it be? Due to the fiscal corona reserve, companies that expect a “corona-related loss” for 2020 can deduct this loss from the taxable profit for 2019. The aim of this measure is to provide companies in a severe loss situation with extra liquidity in the short term. Based on the settled loss, they can (partly) get back the tax paid for 2019. The possibility of creating a fiscal corona reserve does not exist before the 2021 tax year. After all, for the most affected companies, no taxable profit was made for the 2020 tax year, so creating a fiscal corona reserve for expected corona-related losses in 2021 does not lead to extra liquidity. The support and recovery package has since been adapted and expanded several times. Companies receive liquidity support from, among others, the NOW, the TVL and tax deferral. A fiscal corona reserve for 2021 is expected to add little to this package. It is possible that behavioral effects will arise as a result of broadening the regulations. Consider, for example, that by expanding more entrepreneurs will apply for the scheme because it has become more attractive for larger companies. Expanding the schemes may also make it less attractive for entrepreneurs to generate turnover. Both effects lead to a higher entitlement to the scheme. We do not take these possible effects into account with the budgetary estimates of the corona schemes, because this is difficult to quantify. Questions and comments from members of the PVV group The members of the PVV faction have taken note of the letter regarding an overview of budgetary decision-making after the Autumn Memorandum. In response to the above point, the members of the PVV faction have a few more questions. First of all, the members of the PVV faction want to know why this letter to parliament does not contain an update of the estimate of tax revenues and autonomous expenditure development. When will the next update be made? Both tax revenues and autonomous expenditure development are highly dependent on the macroeconomic development estimated by the Central Planning Bureau (CPB). Currently, no current CPB estimate is available that takes into account the current contact-limiting measures and the most recent economic insights. Therefore, no discounting of tax revenues and autonomous expenditure development has been included. At the end of March, the CPB will publish the Central Economic Plan (CEP), containing an update of the expenditure and tax estimates. In the Spring Memorandum, the cabinet will inform parliament about the income, expenditure, EMU balance and EMU debt for 2021. This includes both the CEP estimate and the budgetary consequences of the spring decision-making. With regard to the support and recovery package corona, the members of the PVV faction ask for a breakdown of the 1st to 4th support package. Can the minister indicate per package how much has been budgeted / spent? Since the start of the corona crisis, the government has announced, extended and expanded aid measures several times. The first bailout package was announced on March 17, 2020 and ran for three months until June 1, 2020 (Emergency package jobs and economy). On May 20, 2020, the cabinet announced that it would extend the bailout package by 4 months until October 1, 2020 (Emergency Package 2.0). Subsequently, on 28 August, the government announced that it would extend the support measures by 9 months until 1 July 2021 (the Support and Recovery Package). In addition to these support packages, the government took additional support measures or deepened existing measures at various times in the autumn of 2020 and early 2021. As a result, a strict division of all support measures into four packages cannot be made. In addition, expenditure within the national budget is accounted for at item level and not at support package level. The Central Government Annual Financial Report contains an overview of what has been achieved in 2020 for each aid measure. Finally, the members of the PVV faction note that on January 26, the motion of MP Wilders (Parliamentary Paper 35510, no.7) was passed, in which the cabinet is requested, if necessary, to take over the private debts of the victims of childcare allowance, so that they can keep the 30,000 euros . The members of the PVV faction want to know how and when the cabinet will implement this motion. The cabinet is in talks with various parties, including umbrella organizations and interest groups (such as bailiffs and collection agencies) to find a solution for the whole. In the search for a solution for the duped parents and their debts, where necessary, I include the principles of the Wilders motion. Questions and comments from members of the group of the CDA The members of the CDA party have taken note of the letter from the minister about the budgetary consequences in 2021 of decision-making since the Autumn Memorandum. The letter provides a clear overview of the budgetary consequences, but these members do wonder why table 3 does not include a point-by-point explanation, as with tables 1 and 2. Could the minister still provide similar brief explanations for table 3? to provide? Furthermore, the members of the CDA group have questions about some of the included posts. Table 3 is an update of the total budgetary consequences of the aid and recovery package. The budgetary consequences can be broken down into a number of categories. The EMU-relevant expenditure is all estimated expenditure on the aid measures, including NOW, TOZO and TVL. The fiscal measures are measures taken on the revenue side and the amounts included are the expected lower revenues due to these measures. In addition, there were also loans and lower income expected due to tax deferral. The latter category does not count towards the EMU balance, but it does count towards the EMU debt. In table 1, the members of the CDA group see under point 2 that large amounts have been booked for the provision of services and information management (POK). However, the explanation for this item is very brief and these members cannot find a specification of these amounts in the Cabinet response to the POK’s report. These members therefore ask the government for further explanation of the annually increasing expenditure planned under this item. A breakdown of the amounts under item 2 “services and information management (POK)” is included in the appendix budgetary framework measures to the government’s response to the report “unprecedented injustice” by the Parliamentary interrogation committee on childcare allowance (POK). The reserved resources are intended for the implementation of the (partly structural) measures as announced in the Cabinet response. Under item 3, the members of the CDA group see an item “debt cancellation (POK)”, indicating that the budgetary size is currently being mapped out. The House will be further informed at a later date. Can the minister indicate when this later moment is expected? Will this at least be included in the Spring Memorandum? These members also ask whether the minister can already give a rough estimate of the amounts under this item. The budgetary consequences for canceling debts are currently being made transparent. The House will be informed about this as so

on as possible as soon as there is more clarity about the approach. For public debts, this will be no later than May 1. You will be informed about the solution for private and other debts as soon as more is known. It also needs to be worked out in more detail what a scheme for ex-partners looks like. Based on this, an estimate can be made of the associated costs. The implementation costs can be calculated for both the cancellation of debts and the arrangement for ex-partners as soon as there is further elaboration. After all, the letter tries to provide insight into the effects of the budgetary changes on the EMU debt, but this does not include these amounts. These members would like to have an idea of the order of magnitude they should be thinking about here and what this means for the EMU debt. The same applies to item 12. “Support measures mobility cluster / manufacturing industry, which also includes a“ p.m. ” is included. When will there be more clarity about this and can the minister also give a first rough estimate here? In the letter to Parliament of 12 March 2021 about additions to the economic aid and recovery package, your House was informed that 150 million euros has been made available for the mobility sector. In accordance with the Amhaouch motion, the scheme will be worked out by 15 May at the latest. At item 10 “Implementation costs BIK”, the members of the CDA group ask why a p.m. has been included, while amounts have already been included under the explanation. Are many additional expenses expected? At the moment from afarby sending the letter to Parliament, the implementation costs for the BIK were still insufficiently clear. That is why it has been decided to make a first installment available for the executive departments. In the meantime, the implementation costs for RVO and the Tax Authorities are known and the necessary resources are transferred to the Ministry of Economic Affairs (for RVO) and Finance (for the Tax Authorities) in the Spring Memorandum. Implementation costs BIK (x 1 million euros) 2021 2022 2023 2024 Tax and Customs Administration 0.6 2.9 2.9 2.6 RVO 17.1 29.3 8.9 5.0 The members of the CDA group also have a few questions about the corona support measures. They wonder to what extent an analysis is made of the usefulness and necessity of the measures. For example, the cabinet introduced a zero rate on face masks almost a year ago. This measure has been extended. It was argued that the aim was to make it cheaper for consumers who have to travel by public transport. Moreover, there was no way for them to keep more than a meter and a half apart. The members of the CDA party ask how the requirements of Article 3.1 of the Government Accounts Act are still being met. Do scarcity and / or the height of the price (and thus on the income of people who are obliged to wear them) still justify a zero rate on these personal protective equipment? To what extent do entrepreneurs still pass on the price to consumers? Especially when we look at the production costs of these protective equipment. The cabinet has decided that a zero rate will apply to mouth masks from 25 May in view of the obligation to wear them in public transport. The obligation to wear a face mask has since been extended and extended to all public areas. The aim of the zero rate is to make mouth masks cheaper for consumers. The crisis situation left little room for extensive analysis, for example into alternatives, before the measure was introduced. A recent analysis of the sales prices of masks shows that retailers have largely passed on this VAT reduction. The government intends to evaluate the support and recovery measures taken in 2022 in accordance with Article 3.1 of the Government Accounts Act. It still needs to be mapped out which measures are included in this evaluation, which partly depends on the available data and research options. The members of this group have already asked whether it would not be better to stimulate the supply. Previous questions indicated that a number of sheltered workshops (SW) companies, such as Scalabor in Arnhem and IBN in Uden, played a role in the production. To what extent have more SW companies been involved in the production of face masks since then? And are sufficient medical masks (including FFP2) currently produced in the Netherlands or is the Netherlands still dependent on imports from Asia, especially China? Personal protective equipment (PPE) is readily available for healthcare and can be supplied through regular suppliers. Mouth masks (surgical masks type IIR and FFP2) are now also being produced in the Netherlands. This has reduced the dependence on imports from Asia. Moreover, there are more than enough protective equipment available through the emergency stock of the National Consortium Resources (LCH). The regular purchasing channels of the healthcare institutions and the LCH purchase current stocks from both foreign producers and Dutch producers. It is not known to me whether more sheltered workshop companies are now involved in the production of mouth masks. The share of Dutch production of personal protective equipment compared to foreign production cannot be quantified. I can, however, inform you that the initiatives selected by the cabinet for the production of mouth masks in the Netherlands can provide a substantial share of Dutch demand. Schemes such as the Emergency Measure Bridging for Employment (NOW), Temporary bridging scheme for self-employed persons (Tozo), etc. are intended to absorb the loss of income for companies. In budget-driven organizations that are completely or almost completely dependent on government revenues, there may be a loss of productivity, but this has no consequences for the revenues of the organization, such as education or administrative work for the government. The members of the CDA faction would like to know to what extent and an analysis is made of the lost hours of productivity. Does the government monitor the extent to which lessons are lost in the various types of education from primary to university education? Is it possible to come to a breakdown of how many hours less lessons were taught according to education? ype since schools and universities closed? To what extent is it checked to what extent the quality of digital lessons and lectures compares to traditional lessons and lectures? These members want to know to what extent it is also investigated in other (semi-) government sectors how many hours of production outages there are and to what extent the quality of the service relates to the traditional forms. In primary and secondary education, a monthly survey is carried out to determine the extent to which lessons are canceled. The purpose of these polls is to establish the extent to which pupils have been able to follow education. The focus is not on the labor productivity of teaching staff, but on the development opportunities of students. More information about this monitor study and the monthly reports can be found in the report Continuity of education during corona. The Inspectorate of Education is examining the extent to which the quality of digital lessons and lectures relates to traditional lessons and has started the project “Quality of and supervision of distance learning”. The first phase of the investigation took place in December and January. The Inspectorate carries out the investigation in the sectors of primary education, secondary education, special (secondary) education and secondary vocational education. In addition to its own investigations into distance learning in schools and study programs, the Inspectorate has also developed a questionnaire for pupils and students. This has been used in higher education. The results of these studies will be presented shortly. The quality of online education is monitored in higher education using the regular quality assurance systems, in which the program committees, participation councils, student councils and examination committees play an important role. In addition, additional forms of monitoring take place at many institutions in order to identify what students and teachers

are facing at this time. There is also extra attention for teacher professionalisation, training and knowledge sharing, for example between the chairpersons of examination boards. For other government sectors, there is no generic monthly monitor of production outages or the quality of the current services compared to traditional forms. However, an annual survey is conducted on behalf of the Ministry of the Interior and Kingdom Relations into the quality of government services. The most recent study, “Judge Citizens and Entrepreneurs Government Services 2020, “shows that digital services have increased and are generally positively valued. However, the study does conclude that more traditional forms of contact will continue to be important in the future. Finally, the members of the CDA group see in table 4 a rough estimate of the effect of the decision-making on the EMU debt in 2021. On the basis of the other information in the letter, however, they cannot calculate the amounts of 1.9 billion EUR, EUR 7.6 billion, EUR 4.1 billion and EUR 4.9 billion in the various rules. Can the minister provide further information on this? The amounts in table 4 are structured as follows: – The 1.9 billion regular expenditure decision-making is the total for 2021 from table 1, minus the completion of the in = out target. The in = out target is not included in the balance calculation because it does not lead to a balance tax, assuming that it will be filled in with underutilisation. – The € 7.6 billion expansion of the aid and recovery package on 21 January is the total of extra aid and recovery measures as announced in the letter to Parliament from the Minister of Economic Affairs and Climate of 21 January 2021. – The 4.1 billion tax deferment concerns the reduction in the expected receipt of deferred taxes in 2021 since the letter to Parliament from the Minister of Economic Affairs and Climate regarding ‘specific adjustments in economic support and recovery package’ of December 18, 2020. The net decrease of the revenues from tax deferment in 2021 will have an increasing effect on the EMU debt in 2021. – The 4.9 billion previous policy corona mutations is the total of support and recovery measures between the Autumn Memorandum and the extension of the support and recovery package of 21 January. The members of the SP group see that no estimate has yet been made for the cancellation of debts for victims of the benefits affair. These members ask about the total outstanding debts of these victims with the tax authorities themselves. They also read in the letter to which the Minister refers (Parliamentary Paper 31066, no. 773) that other government institutions will proceed to remission unless there is serious abuse. These members ask the minister about the criteria used for serious abuse. How will it be assessed whether this is the case and how will the right to object be for the they styled dupes? They ask the minister how the consultations with the Association of Dutch Municipalities are going about the victims who have ended up in debt counseling at municipalities. The members of the SP group also see that tackling the debt problem is only foreseen for 2021 and not in further years. They ask the Minister to what extent they can assume that this will actually be completed in 2021, given the numerous number of consultations that are still taking place. Government-wide efforts are currently being made at the ministries concerned to provide insight into the public debts of victims and to develop concrete measures to cancel the debts. You will be informed about this by 1 May at the latest. Debts arising from serious abuse or negligence are exempt from remission. This is the case, for example, when the occurrence of a debt is demonstrably culpable on the part of the parent or his partner. The exact effect of what falls under the term “serious abuse” differs per government institution. The State Secretary works closely with the relevant ministries and the VNG on the debt file. We are working together on a solution to the debt problem, paying attention to different target groups. We also speak of parents who are already in debt counseling. The State Secretary is aware that parents benefit from a quick solution for their private and other debts. This also requires good coordination about the feasibility of this solution, both within the Implementation of Recovery Allowances (UHT) and within municipalities. As soon as more is clear about the solution and the implementation consequences, your House will be informed about the timeline. The members of the SP faction also note that a very large proportion of the major creditors consist of private organizations that perform a public task. They see that the government must now consult with these organizations about the cancellation of debts at health insurers and energy companies, among others. These members ask the minister what conditions he will be willing to accept under which remission will take place, what compensation he will be willing to provide and whether privatization of companies that perform public tasks should be considered a successful strategy in this context. of safeguarding the public interest. They find that much of the necessary expenditure of victims, who often belong to the socio-economic underclass, goes to these companies that perform public tasks and that a disproportionate share of this general interest in these companies is invested in the Dutch debt problem. The State Secretary of Finance is in talks with umbrella organizations of large private creditors to find a solution for these debts. The solution how to arrive at a solution for duped parents is independent of the question whether companies that are creditor of duped parents have a public task or not. The members of the SP faction see in their answers to the factual questions about the incidental supplementary budget that 57 million euros is spent on hiring, which also includes assignments to consultancy firms. These members ask the Minister about the expenditure on external hiring that is expected to be involved in the implementation of the first three parts of the decision-making that is currently under consideration, how these relate to the regular personnel expenditure and whether this involves a violation of the Roemer standard. . They also ask the Minister about the scope of the consultancy assignments that have already been awarded in the context of this supplementary budget. They note that, if the emergency track for the implementation law on electronic commerce guidelines is followed, a great deal of claim must be made on external hiring and ask the minister whether his personnel policy contains sufficient tolerance to deal with these cases. They note that, if errors of a similar nature are also to be corrected in the other allowances and in income tax, even greater pressure will be placed on the Tax and Customs Administration and they ask the Minister about his plans to incorporate this in the personnel policy. In the incidental supplementary budget for recovery allowances, an additional budget of 40 million euros was made available in 2021 for external hiring in the Implementation of Recovery Allowances (UHT), bringing the total budget for external hiring in 2021 to 57 million euros. This hiring is necessary to be able to perform the tasks of the temporary organization flexibly and with the correct specific expertise, for example to be able to scale up and down quickly. The available budget for our own personnel is 28 million euros in 2021. Make for the specification of the external hiring we distinguish three categories: 1) Commitment to the primary process and support (structural). Already compulsory in 2021: 21 million euros 2) Commitment to setting up and organizing an organization (incidental). Already mandatory in 2021: 3 million euros 3) Advisory assignments: external investigations related to the recovery organization. Already compulsory in 2021: 2 million euros We also expect to enter into new commitments later in the year. The resources reserved for part 2 of the decision-making process (services and information

management POK) are intended for the implementation of the measures as announced in the cabinet response to the report “unprecedented injustice” of the Parliamentary interrogation committee on childcare allowance (POK). The plans for this are currently being worked out in more detail. The annual plan of the Tax and Customs Administration deals with the personnel policy. It states that the Tax and Customs Administration exceeds the applicable standard for hiring external parties. At the same time, the Tax and Customs Administration is working on gradually phasing out external hiring where possible. It continuously takes into account the developments you mention.

After that, the cabinet can inform parliament in the Spring Memorandum about the income, expenditure, EMU balance and EMU debt for 2021. The members of the VVD faction would like a more extensive substantiation of the amounts under item 2 “services and information management (POK)”. What exactly is being done for that? And why do those costs continue up to and including 2026? A breakdown of the amounts under item 2 “services and information management (POK)” is included in the appendix budgetary framework measures to the government’s response to the report “unprecedented injustice” by the Parliamentary interrogation committee on childcare allowance (POK). The reserved resources are intended for the implementation of the (partly structural) measures as announced in the Cabinet response. The members of the VVD group read that for 2021 to 2026 there are p.m. posts for the national program education after corona. How long is the duration of this program? And when is more clear about the costs and coverage? And why is the reservation for ventilation for the school buildings only in 2022 and 2023? Isn’t there a need for investments in ventilation in the context of Corona? When the relevant letter to Parliament was sent on 27 January last, the national program for education after corona was still being worked out. Because at that time already it was clear that the program (not yet quantifiable) would have budgetary consequences included in the letter p.m. items. On 17 February last, the cabinet informed the House of the details of the program by means of a letter to Parliament. It states that the program will run up to and including the 2022/2023 school year for primary and secondary education and up to and including 2022 for secondary and higher vocational education. A total of 8.5 billion is incidentally available for the program during this period. In addition, the consequences of the estimate of the numbers of pupils and students (increasing to 645 million structurally from 2026) and the study grant estimate (increasing to 132 million in 2026) are also generally processed. The House will be informed about this processing in the Spring Memorandum. On 1 October last, the House was informed by means of a letter to Parliament about the results of the investigation by the National Coordination Team Ventilation School Buildings (LCVS). In the same letter, a financial investment of 360 million was announced. Of that 360 million, 100 million has been made available via the SUVIS scheme, which will enable necessary ventilation measures in schools to be financed in the short term (2021). The remaining 260 million has been reserved by the cabinet for the years after 2021, so that the results of the Interdepartmental Policy Survey on Educational Housing can be included in the manner of spending. The members of the VVD faction see that the administrative agreements are getting stronger g Groningen are included. However, agreements have also been made about the reservoir regulation and the Norg gas storage. How and when are these processed in the financial picture? Why have these not yet been included, possibly as a p.m. post, for example? An update of the multi-year forecast is being worked on, when can the House be informed about this in more detail? The letter to Parliament gives an overview of those files with an effect on the expenditure ceiling up to the end of January on which a decision has already been taken. The reservoir regulation and the Norg gas storage are not included in the scope of this letter. Due to a reservation on the additional item, the reservoir regulation has no influence on the expenditure ceiling and will be incorporated in the Spring Memorandum 2021. On 9 March last, your House was informed of the signing of the Norg agreement (reference 2021Z04373). In accordance with the Norg Fee Agreement, GasTerra will draw up a calculation method for the fee, which will be determined by an arbitration panel. After it has been determined, the compensation

is processed in a budgetary manner. The multi-annual estimates are currently being worked on. This is a complex process. It is not yet possible to say when this process will be completed. The House will be informed about this at a later time. Funds have been included for the investment package Curaçao, Aruba and Sint Maarten. What does the structural part of the investment package consist of? The members of the VVD group would like to receive a breakdown (per measure and per country). The structural part of the investment package Curaçao, Aruba and Sint Maarten consists of investments in the rule of law. All expenditure under the rule of law is presented below, including incidental contributions. Investment package rule of law (x € million) 2020 2021 2022 2023 2024 2025 2026 struc. Curaçao 1.2 18.3 19.6 19.5 19.6 24.9 24.9 24.9 Strengthening border control (including Coastguard) 16.3 16.8 15.5 14.4 18.5 18.5 18.5 Sustainable undermining approach 0.4 1.6 2.8 4.0 5.2 5.2 5.2 Professionalizing ARUMIL and Social Training Course 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.2 Harmonization of personal data 0.4 Aruba 0.8 12.5 15.0 14.3 14.9 17.8 17.8 17.8 Strengthening border control 11.1 11.8 9.3 8.1 9.3 9.3 9.3 Sustainable undermining approach 0.6 2.4 4.2 6.0 7.7 7.7 7.7 Professionalising ARUMIL and Social Training program 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 Sint Maarten 0.0 2.7 2.9 2.7 2.4 2.7 2.7 2.7 Strengthening border control 2.7 2.9 2.7 2.4 2.7 2.7 2.7 Total 2.4 33.5 37.5 36.5 36.9 45.4 45.4 45.4 The members of the VVD group note that before 2021, the entire on = deferred assignment still has to be completed. Is it true that this is in addition to the in = de-commissioning of 1.2 billion euros, which still has to be completed by the Final Act? If not, what about then? What is the state of affairs regarding the implementation of this assignment? In the Autumn Memorandum 2020, an in = out target of 1.2 billion euros was open. The in = out target is the counterpart of the year-end margin. The end-of-year margin is intended to prevent ineffective use of resources at the end of the year by transferring the unspent resources to the following year. This is subject to a maximum of 1.0 percent of the total budget, with the exception of the defense equipment budget fund and the infrastructure fund, which have a 100 percent year-end margin. In order to prevent the expenditure ceiling from being exceeded as a result of the year-end margin, an equally large target is entered in the Spring Memorandum, the so-called in = out target. As a result, the transfer via the end-of-year margin does not generate additional resources in the year to which the transfer is made. The in = out target has no concrete interpretation, but is completed during the year. The interpretation can consist of (accidental) under-exhaustion or other windfalls. The remaining in = out target for 2020 for the Final Act amounts to 1.2 billion euros. This is a risk for the treasury: if the target cannot be met by the Final Act, this means a ceiling exceedance and a deterioration of the EMU balance in 2020. In addition to the in = out target, the Spring Memorandum has a target underutilisation of 500 million euros for the year 2020 in order to close the expenditure ceiling, this target is fully specified in the Millionnota with windfalls. An in = out target will also be booked for 2021 as a counterpart to the resources that will be carried forward from 2020 via the end-of-year margin. target for 2021. In addition to the in = out target, there is a target underutilization of 950 million euros for the year 20 for the 2021 Budget Memorandum. 21 booked to close the spending ceiling. Just like the in = out target in 2021, this target will have to be completed with underutilization or other windfalls. The members of the VVD faction would like to know what the “stock options envelope” is (was) for. In the context of the tax treatment of stock options as wages for employees of start-ups and scale-ups, among others, it is being investigated to what extent the current tax moment (time of exercise of the options) can be shifted to a time when liquid assets available to be able to pay the tax due at that time. A measure had been worked out for this with an intended entry into force date of 1 January 2021. 5 million euros had been reserved for this by 2021. After consultation with stock option experts, it has emerged that it is not clear whether this measure has the intended effect in enough cases. The proposal is therefore being further elaborated. The intended entry into force of the measure will then be effective 1 January 2022 and the measure is expected to be included in the Tax Plan 2022. This means that the envelope of 5 million euros will not be used in 2021. In the amendment by Member Lodders, the stock options envelope for the year 2021 has been used to cover a temporary increase in the gift tax exemption of 1,000 euros. From 2022, the envelope will be used to adjust the tax treatment of stock options. The members of the VVD group ask for a further explanation of point 7 “recalibration of Sofina judgment including countermeasure”. What exactly is meant here? What exactly does it say here? The answer below is a short version of the earlier explanation given in the Letter to Parliament on the development of the income side of 15 December 2020. An earlier judgment of the EU Court of Justice in the French Sofina case has partially approved the restitution of dividends and gambling tax to foreign portfolio shareholders. In this case, compared to the earlier estimate, there is now a budgetary windfall of 460 million euros in 2021 and 180 million euros cumulative in later years. The judgment in the Sofina case has consequences for the current law whereby bodies established in the Netherlands can fully offset the dividend tax and gambling tax against the amount of corporate income tax owed, even if they are loss-making. Bodies established abroad that are otherwise in the same position as entities established in the Netherlands do not have this settlement option. This difference is most likely not allowed in view of the judgment of the EU Court of Justice in the French Sofina case. For the above reason, the refund of dividends and gambling tax to foreign portfolio shareholders will be approved from 2021. During the August decision-making process, the Sofina case led to a loss of 910 million euros in 2021, as also reported in the tax framework annex to the Budget Memorandum. It was previously agreed that the loss of 910 million euros in 2021 with a framework correction will be offset against the proceeds from the countermeasure in later years. However, it now appears that by including a recall option in the policy decision when the foreign portfolio shareholder does become profitable in a year later, the loss is limited (see table 1). As shown in table 1, this gives a windfall of 460 million euros in 2021 and 180 million euros cumulative up to and including 2026, compared to the path agreed in the August decision-making. Compared to this agreement in the Budget Memorandum, the current windfall of 460 million euros + 180 million euros in expenses is relevant for the income framework. Table 1 Including countermeasure 2021 2022 2023 2024 2025 2026 2027 Structural Old estimate Sofina judgment -910 240 190 160 130 110 80 20 New estimate Sofina judgment -450 310 240 190 150 120 80 20 Budgetary income due to difference 460 70 50 30 20 10 0 0 By mistake, table 2 in the letter to Parliament of 27 January shows the new estimate entered on the EMU basis on the revenue side of the budget. There the difference between the old estimate and the new estimate of the Sofina remainder (row 3 in bold in table 1 above) should have been shown. As described above, this has been used to cover setbacks in the health insurance premium. In this way, the income framework will close again in 2021. The members of the VVD group understand that not everything is clear for the allowance file yet. Which parts are not yet transparent? When can the House be further informed about the financial consequences? The budgetary consequences fo

r canceling debts are currently being made transparent. The House will be informed about this as soon as possible as soon as more clear kheid is about the approach. For public debts, this will be no later than May 1. You will be informed about the solution for private and other debts as soon as more is known. It also needs to be worked out in more detail what a scheme for ex-partners looks like. Based on this, an estimate can be made of the associated costs. The implementation costs can be calculated for both the cancellation of debts and the arrangement for ex-partners as soon as there is further elaboration. The members of the VVD group wonder whether extending the possibility of a fiscal corona reserve in 2021 would not be a useful measure. What could that deliver? Table 3 states that a number of measures are “exclusive of behavioral effects”. What kind of behavioral effects can it be? Due to the fiscal corona reserve, companies that expect a “corona-related loss” for 2020 can deduct this loss from the taxable profit for 2019. The aim of this measure is to provide companies in a severe loss situation with extra liquidity in the short term. Based on the settled loss, they can (partly) get back the tax paid for 2019. The possibility of creating a fiscal corona reserve does not exist before the 2021 tax year. After all, for the most affected companies, no taxable profit was made for the 2020 tax year, so creating a fiscal corona reserve for expected corona-related losses in 2021 does not lead to extra liquidity. The support and recovery package has since been adapted and expanded several times. Companies receive liquidity support from, among others, the NOW, the TVL and tax deferral. A fiscal corona reserve for 2021 is expected to add little to this package. It is possible that behavioral effects will arise as a result of broadening the regulations. Consider, for example, that by expanding more entrepreneurs will apply for the scheme because it has become more attractive for larger companies. Expanding the schemes may also make it less attractive for entrepreneurs to generate turnover. Both effects lead to a higher entitlement to the scheme. We do not take these possible effects into account with the budgetary estimates of the corona schemes, because this is difficult to quantify. Questions and comments from members of the PVV group The members of the PVV faction have taken note of the letter regarding an overview of budgetary decision-making after the Autumn Memorandum. In response to the above point, the members of the PVV faction have a few more questions. First of all, the members of the PVV faction want to know why this letter to parliament does not contain an update of the estimate of tax revenues and autonomous expenditure development. When will the next update be made? Both tax revenues and autonomous expenditure development are highly dependent on the macroeconomic development estimated by the Central Planning Bureau (CPB). Currently, no current CPB estimate is available that takes into account the current contact-limiting measures and the most recent economic insights. Therefore, no discounting of tax revenues and autonomous expenditure development has been included. At the end of March, the CPB will publish the Central Economic Plan (CEP), containing an update of the expenditure and tax estimates. In the Spring Memorandum, the cabinet will inform parliament about the income, expenditure, EMU balance and EMU debt for 2021. This includes both the CEP estimate and the budgetary consequences of the spring decision-making. With regard to the support and recovery package corona, the members of the PVV faction ask for a breakdown of the 1st to 4th support package. Can the minister indicate per package how much has been budgeted / spent? Since the start of the corona crisis, the government has announced, extended and expanded aid measures several times. The first bailout package was announced on March 17, 2020 and ran for three months until June 1, 2020 (Emergency package jobs and economy). On May 20, 2020, the cabinet announced that it would extend the bailout package by 4 months until October 1, 2020 (Emergency Package 2.0). Subsequently, on 28 August, the government announced that it would extend the support measures by 9 months until 1 July 2021 (the Support and Recovery Package). In addition to these support packages, the government took additional support measures or deepened existing measures at various times in the autumn of 2020 and early 2021. As a result, a strict division of all support measures into four packages cannot be made. In addition, expenditure within the national budget is accounted for at item level and not at support package level. The Central Government Annual Financial Report contains an overview of what has been achieved in 2020 for each aid measure. Finally, the members of the PVV faction note that on January 26, the motion of MP Wilders (Parliamentary Paper 35510, no.7) was passed, in which the cabinet is requested, if necessary, to take over the private debts of the victims of childcare allowance, so that they can keep the 30,000 euros . The members of the PVV faction want to know how and when the cabinet will implement this motion. The cabinet is in talks with various parties, including umbrella organizations and interest groups (such as bailiffs and collection agencies) to find a solution for the whole. In the search for a solution for the duped parents and their debts, where necessary, I include the principles of the Wilders motion. Questions and comments from members of the group of the CDA The members of the CDA party have taken note of the letter from the minister about the budgetary consequences in 2021 of decision-making since the Autumn Memorandum. The letter provides a clear overview of the budgetary consequences, but these members do wonder why table 3 does not include a point-by-point explanation, as with tables 1 and 2. Could the minister still provide similar brief explanations for table 3? to provide? Furthermore, the members of the CDA group have questions about some of the included posts. Table 3 is an update of the total budgetary consequences of the aid and recovery package. The budgetary consequences can be broken down into a number of categories. The EMU-relevant expenditure is all estimated expenditure on the aid measures, including NOW, TOZO and TVL. The fiscal measures are measures taken on the revenue side and the amounts included are the expected lower revenues due to these measures. In addition, there were also loans and lower income expected due to tax deferral. The latter category does not count towards the EMU balance, but it does count towards the EMU debt. In table 1, the members of the CDA group see under point 2 that large amounts have been booked for the provision of services and information management (POK). However, the explanation for this item is very brief and these members cannot find a specification of these amounts in the Cabinet response to the POK’s report. These members therefore ask the government for further explanation of the annually increasing expenditure planned under this item. A breakdown of the amounts under item 2 “services and information management (POK)” is included in the appendix budgetary framework measures to the government’s response to the report “unprecedented injustice” by the Parliamentary interrogation committee on childcare allowance (POK). The reserved resources are intended for the implementation of the (partly structural) measures as announced in the Cabinet response. Under item 3, the members of the CDA group see an item “debt cancellation (POK)”, indicating that the budgetary size is currently being mapped out. The House will be further informed at a later date. Can the minister indicate when this later moment is expected? Will this at least be included in the Spring Memorandum? These members also ask whether the minister can already give a rough estimate of the amounts under this item. The budgetary consequences for canceling debts are currently being made transparent. The House will be informed about this as so

on as possible as soon as there is more clarity about the approach. For public debts, this will be no later than May 1. You will be informed about the solution for private and other debts as soon as more is known. It also needs to be worked out in more detail what a scheme for ex-partners looks like. Based on this, an estimate can be made of the associated costs. The implementation costs can be calculated for both the cancellation of debts and the arrangement for ex-partners as soon as there is further elaboration. After all, the letter tries to provide insight into the effects of the budgetary changes on the EMU debt, but this does not include these amounts. These members would like to have an idea of the order of magnitude they should be thinking about here and what this means for the EMU debt. The same applies to item 12. “Support measures mobility cluster / manufacturing industry, which also includes a“ p.m. ” is included. When will there be more clarity about this and can the minister also give a first rough estimate here? In the letter to Parliament of 12 March 2021 about additions to the economic aid and recovery package, your House was informed that 150 million euros has been made available for the mobility sector. In accordance with the Amhaouch motion, the scheme will be worked out by 15 May at the latest. At item 10 “Implementation costs BIK”, the members of the CDA group ask why a p.m. has been included, while amounts have already been included under the explanation. Are many additional expenses expected? At the moment from afarby sending the letter to Parliament, the implementation costs for the BIK were still insufficiently clear. That is why it has been decided to make a first installment available for the executive departments. In the meantime, the implementation costs for RVO and the Tax Authorities are known and the necessary resources are transferred to the Ministry of Economic Affairs (for RVO) and Finance (for the Tax Authorities) in the Spring Memorandum. Implementation costs BIK (x 1 million euros) 2021 2022 2023 2024 Tax and Customs Administration 0.6 2.9 2.9 2.6 RVO 17.1 29.3 8.9 5.0 The members of the CDA group also have a few questions about the corona support measures. They wonder to what extent an analysis is made of the usefulness and necessity of the measures. For example, the cabinet introduced a zero rate on face masks almost a year ago. This measure has been extended. It was argued that the aim was to make it cheaper for consumers who have to travel by public transport. Moreover, there was no way for them to keep more than a meter and a half apart. The members of the CDA party ask how the requirements of Article 3.1 of the Government Accounts Act are still being met. Do scarcity and / or the height of the price (and thus on the income of people who are obliged to wear them) still justify a zero rate on these personal protective equipment? To what extent do entrepreneurs still pass on the price to consumers? Especially when we look at the production costs of these protective equipment. The cabinet has decided that a zero rate will apply to mouth masks from 25 May in view of the obligation to wear them in public transport. The obligation to wear a face mask has since been extended and extended to all public areas. The aim of the zero rate is to make mouth masks cheaper for consumers. The crisis situation left little room for extensive analysis, for example into alternatives, before the measure was introduced. A recent analysis of the sales prices of masks shows that retailers have largely passed on this VAT reduction. The government intends to evaluate the support and recovery measures taken in 2022 in accordance with Article 3.1 of the Government Accounts Act. It still needs to be mapped out which measures are included in this evaluation, which partly depends on the available data and research options. The members of this group have already asked whether it would not be better to stimulate the supply. Previous questions indicated that a number of sheltered workshops (SW) companies, such as Scalabor in Arnhem and IBN in Uden, played a role in the production. To what extent have more SW companies been involved in the production of face masks since then? And are sufficient medical masks (including FFP2) currently produced in the Netherlands or is the Netherlands still dependent on imports from Asia, especially China? Personal protective equipment (PPE) is readily available for healthcare and can be supplied through regular suppliers. Mouth masks (surgical masks type IIR and FFP2) are now also being produced in the Netherlands. This has reduced the dependence on imports from Asia. Moreover, there are more than enough protective equipment available through the emergency stock of the National Consortium Resources (LCH). The regular purchasing channels of the healthcare institutions and the LCH purchase current stocks from both foreign producers and Dutch producers. It is not known to me whether more sheltered workshop companies are now involved in the production of mouth masks. The share of Dutch production of personal protective equipment compared to foreign production cannot be quantified. I can, however, inform you that the initiatives selected by the cabinet for the production of mouth masks in the Netherlands can provide a substantial share of Dutch demand. Schemes such as the Emergency Measure Bridging for Employment (NOW), Temporary bridging scheme for self-employed persons (Tozo), etc. are intended to absorb the loss of income for companies. In budget-driven organizations that are completely or almost completely dependent on government revenues, there may be a loss of productivity, but this has no consequences for the revenues of the organization, such as education or administrative work for the government. The members of the CDA faction would like to know to what extent and an analysis is made of the lost hours of productivity. Does the government monitor the extent to which lessons are lost in the various types of education from primary to university education? Is it possible to come to a breakdown of how many hours less lessons were taught according to education? ype since schools and universities closed? To what extent is it checked to what extent the quality of digital lessons and lectures compares to traditional lessons and lectures? These members want to know to what extent it is also investigated in other (semi-) government sectors how many hours of production outages there are and to what extent the quality of the service relates to the traditional forms. In primary and secondary education, a monthly survey is carried out to determine the extent to which lessons are canceled. The purpose of these polls is to establish the extent to which pupils have been able to follow education. The focus is not on the labor productivity of teaching staff, but on the development opportunities of students. More information about this monitor study and the monthly reports can be found in the report Continuity of education during corona. The Inspectorate of Education is examining the extent to which the quality of digital lessons and lectures relates to traditional lessons and has started the project “Quality of and supervision of distance learning”. The first phase of the investigation took place in December and January. The Inspectorate carries out the investigation in the sectors of primary education, secondary education, special (secondary) education and secondary vocational education. In addition to its own investigations into distance learning in schools and study programs, the Inspectorate has also developed a questionnaire for pupils and students. This has been used in higher education. The results of these studies will be presented shortly. The quality of online education is monitored in higher education using the regular quality assurance systems, in which the program committees, participation councils, student councils and examination committees play an important role. In addition, additional forms of monitoring take place at many institutions in order to identify what students and teachers

are facing at this time. There is also extra attention for teacher professionalisation, training and knowledge sharing, for example between the chairpersons of examination boards. For other government sectors, there is no generic monthly monitor of production outages or the quality of the current services compared to traditional forms. However, an annual survey is conducted on behalf of the Ministry of the Interior and Kingdom Relations into the quality of government services. The most recent study, “Judge Citizens and Entrepreneurs Government Services 2020, “shows that digital services have increased and are generally positively valued. However, the study does conclude that more traditional forms of contact will continue to be important in the future. Finally, the members of the CDA group see in table 4 a rough estimate of the effect of the decision-making on the EMU debt in 2021. On the basis of the other information in the letter, however, they cannot calculate the amounts of 1.9 billion EUR, EUR 7.6 billion, EUR 4.1 billion and EUR 4.9 billion in the various rules. Can the minister provide further information on this? The amounts in table 4 are structured as follows: – The 1.9 billion regular expenditure decision-making is the total for 2021 from table 1, minus the completion of the in = out target. The in = out target is not included in the balance calculation because it does not lead to a balance tax, assuming that it will be filled in with underutilisation. – The € 7.6 billion expansion of the aid and recovery package on 21 January is the total of extra aid and recovery measures as announced in the letter to Parliament from the Minister of Economic Affairs and Climate of 21 January 2021. – The 4.1 billion tax deferment concerns the reduction in the expected receipt of deferred taxes in 2021 since the letter to Parliament from the Minister of Economic Affairs and Climate regarding ‘specific adjustments in economic support and recovery package’ of December 18, 2020. The net decrease of the revenues from tax deferment in 2021 will have an increasing effect on the EMU debt in 2021. – The 4.9 billion previous policy corona mutations is the total of support and recovery measures between the Autumn Memorandum and the extension of the support and recovery package of 21 January. The members of the SP group see that no estimate has yet been made for the cancellation of debts for victims of the benefits affair. These members ask about the total outstanding debts of these victims with the tax authorities themselves. They also read in the letter to which the Minister refers (Parliamentary Paper 31066, no. 773) that other government institutions will proceed to remission unless there is serious abuse. These members ask the minister about the criteria used for serious abuse. How will it be assessed whether this is the case and how will the right to object be for the they styled dupes? They ask the minister how the consultations with the Association of Dutch Municipalities are going about the victims who have ended up in debt counseling at municipalities. The members of the SP group also see that tackling the debt problem is only foreseen for 2021 and not in further years. They ask the Minister to what extent they can assume that this will actually be completed in 2021, given the numerous number of consultations that are still taking place. Government-wide efforts are currently being made at the ministries concerned to provide insight into the public debts of victims and to develop concrete measures to cancel the debts. You will be informed about this by 1 May at the latest. Debts arising from serious abuse or negligence are exempt from remission. This is the case, for example, when the occurrence of a debt is demonstrably culpable on the part of the parent or his partner. The exact effect of what falls under the term “serious abuse” differs per government institution. The State Secretary works closely with the relevant ministries and the VNG on the debt file. We are working together on a solution to the debt problem, paying attention to different target groups. We also speak of parents who are already in debt counseling. The State Secretary is aware that parents benefit from a quick solution for their private and other debts. This also requires good coordination about the feasibility of this solution, both within the Implementation of Recovery Allowances (UHT) and within municipalities. As soon as more is clear about the solution and the implementation consequences, your House will be informed about the timeline. The members of the SP faction also note that a very large proportion of the major creditors consist of private organizations that perform a public task. They see that the government must now consult with these organizations about the cancellation of debts at health insurers and energy companies, among others. These members ask the minister what conditions he will be willing to accept under which remission will take place, what compensation he will be willing to provide and whether privatization of companies that perform public tasks should be considered a successful strategy in this context. of safeguarding the public interest. They find that much of the necessary expenditure of victims, who often belong to the socio-economic underclass, goes to these companies that perform public tasks and that a disproportionate share of this general interest in these companies is invested in the Dutch debt problem. The State Secretary of Finance is in talks with umbrella organizations of large private creditors to find a solution for these debts. The solution how to arrive at a solution for duped parents is independent of the question whether companies that are creditor of duped parents have a public task or not. The members of the SP faction see in their answers to the factual questions about the incidental supplementary budget that 57 million euros is spent on hiring, which also includes assignments to consultancy firms. These members ask the Minister about the expenditure on external hiring that is expected to be involved in the implementation of the first three parts of the decision-making that is currently under consideration, how these relate to the regular personnel expenditure and whether this involves a violation of the Roemer standard. . They also ask the Minister about the scope of the consultancy assignments that have already been awarded in the context of this supplementary budget. They note that, if the emergency track for the implementation law on electronic commerce guidelines is followed, a great deal of claim must be made on external hiring and ask the minister whether his personnel policy contains sufficient tolerance to deal with these cases. They note that, if errors of a similar nature are also to be corrected in the other allowances and in income tax, even greater pressure will be placed on the Tax and Customs Administration and they ask the Minister about his plans to incorporate this in the personnel policy. In the incidental supplementary budget for recovery allowances, an additional budget of 40 million euros was made available in 2021 for external hiring in the Implementation of Recovery Allowances (UHT), bringing the total budget for external hiring in 2021 to 57 million euros. This hiring is necessary to be able to perform the tasks of the temporary organization flexibly and with the correct specific expertise, for example to be able to scale up and down quickly. The available budget for our own personnel is 28 million euros in 2021. Make for the specification of the external hiring we distinguish three categories: 1) Commitment to the primary process and support (structural). Already compulsory in 2021: 21 million euros 2) Commitment to setting up and organizing an organization (incidental). Already mandatory in 2021: 3 million euros 3) Advisory assignments: external investigations related to the recovery organization. Already compulsory in 2021: 2 million euros We also expect to enter into new commitments later in the year. The resources reserved for part 2 of the decision-making process (services and information

management POK) are intended for the implementation of the measures as announced in the cabinet response to the report “unprecedented injustice” of the Parliamentary interrogation committee on childcare allowance (POK). The plans for this are currently being worked out in more detail. The annual plan of the Tax and Customs Administration deals with the personnel policy. It states that the Tax and Customs Administration exceeds the applicable standard for hiring external parties. At the same time, the Tax and Customs Administration is working on gradually phasing out external hiring where possible. It continuously takes into account the developments you mention.