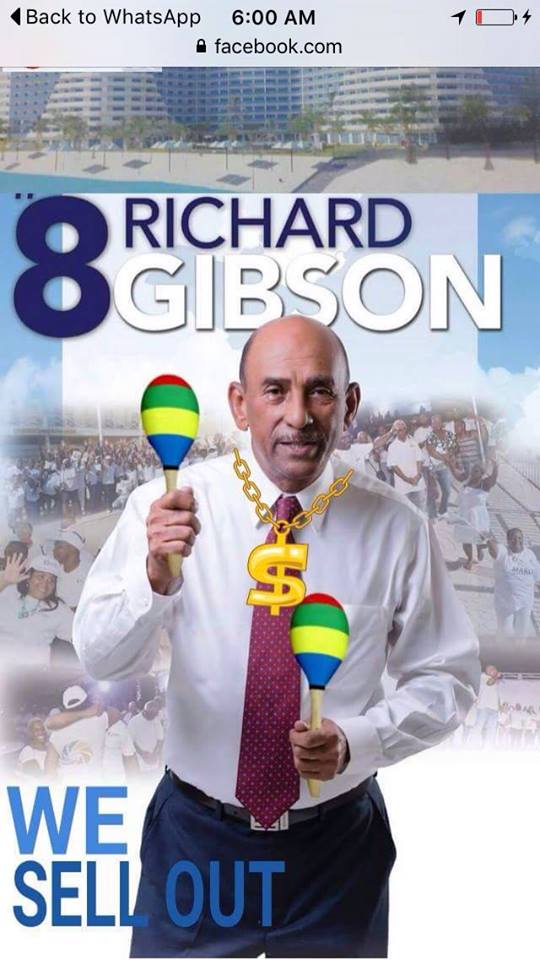

When I posted the PDF document below, maybe I did not get everything in the translation exact, but the gist is true. After I posted the PDF, they came out with all types of spin, now read this below. Don’t let them fool you, St Maarten is up to its ass in debt, St Maarten cannot pay its government workers. St Maarten makes BILLIONS per year, from tourism to loans, to the sex trade and drugs, St Maarten makes BILLIONS annually! So where is the money going???? And this so called Minister of Finance Richard Gibson OWNS the Today Newspaper, and you people actually expect a fair, true and actual detail from the newspapers concerning what is going on with St Maarten and its finances?

ST MAARTEN MINISTER OF FINANCE RICHARD GIBSON NEEDS TO TAKE A PAYDAY LOAD ST MAARTEN IS IN DEEP DEBT

kamerbrief-over-verlening-aflopende-lening-sint-maarten

Finance Minister Richard Gibson Sr. said Wednesday he disagreed with the mid-year report of the Committee for Financial Supervision CFT that the country’s budget income for this year is not keeping track with actual collections.

While there has been some shortfall due to the slower world economy, loss of cruise ship calls, and less Turnover Tax (ToT) due to decline in business activities, Gibson Sr. told the press the country has expectation of additional income. Some of that income is already in the bank in the form of NAf. 9.2 million in dividends from the Central Bank of Curaçao and St. Maarten.

“I did not support or agree with CFT. They don’t take into consideration the figures I have provided nor the payment of dividends from Central Bank nor the windfall from amassed revenues from water company of some NAf. 17 million,” said Gibson.

The CFT’s assessment of the country’s income realisation has led to the Kingdom Government halting the contracting of any new loan. The Central Bank, on the request of St. Maarten, was poised to issue a new bond, but this was abandoned after CFT judged the 2016 budget as not meeting its goals.

Instead of allowing a new loan via the bond, the Kingdom Government has opted to the extension of the timeframe for St. Maarten to repayment of a NAf. 26 million bond which will soon come due. The Kingdom Government is the main subscriber to that bond.

By indicating it will not subscribe to the new bond issuance, the bond was cancelled. In its place, the Kingdom Government has decided to extend the loan for seven years at 0.5 per cent interest. No payment on the loan is due in the first two years, but as of the third year the country has to pay out some NAf. 5 million annually to service the loan.

Gibson Sr. has “a mixed feeling” about the extension. “One, it is a cheaper financing mechanism for us. On the other hand, it will not give us the long term repayment schedule we had in mind with the [new – Ed.] bond but this loan will be paid off in seven years, instead of 15 years of paying interest and having a balloon payment at the end,” he said.

Looking forward to 2017, the Council of Advice is expected to send the draft 2017 Budget to the Council of Ministers via Governor Eugene Holiday this week. The comments of the Council of Advice will be reviewed and replied to by the Ministers before the draft budget is sent to Parliament for debate.

With the return of the draft budget by the Council of Advice, “the path is cleared for Parliament to get the budget passed before the end of this year,” Gibson Sr. said.

On the banking front, the United States (US) Government has expressed interest in working with Dutch Caribbean islands and Jamaica on tackling the de-risking of commercial banks and using those jurisdictions as examples to the world. However, the US requires the Netherlands to be on board to facilitate this process. The Netherlands has expressed some concerns about supporting its partners in the Caribbean part of the kingdom.

Gibson Sr. said the Dutch Government’s reluctance stems from concerns about supervision of the Central Bank. The Dutch Government must realise how important de-risking is to the economy and people of the island and should have no hesitation.

PREVIOUS ARTICLE

Casinos have 9 months to settle arrears, sizeable payments made

Best Carnival And Jouvert Photos, Videos and Info